cumulative preferred stock formula

First determine the preferred stocks annual dividend payment by multiplying the dividend. The dividend on cumulative preferred stock for current period is always deducted from net income while computing current periods EPS even if management does not declare any divided during the period.

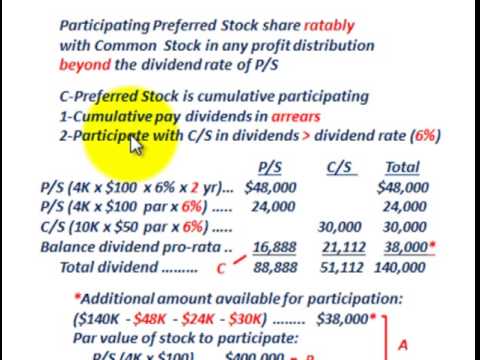

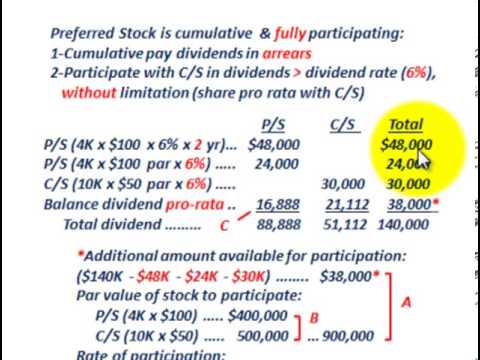

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

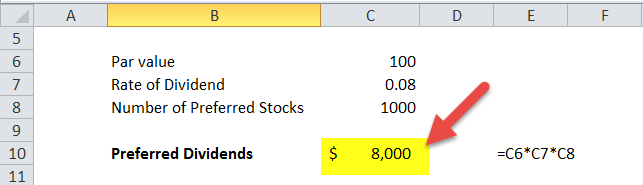

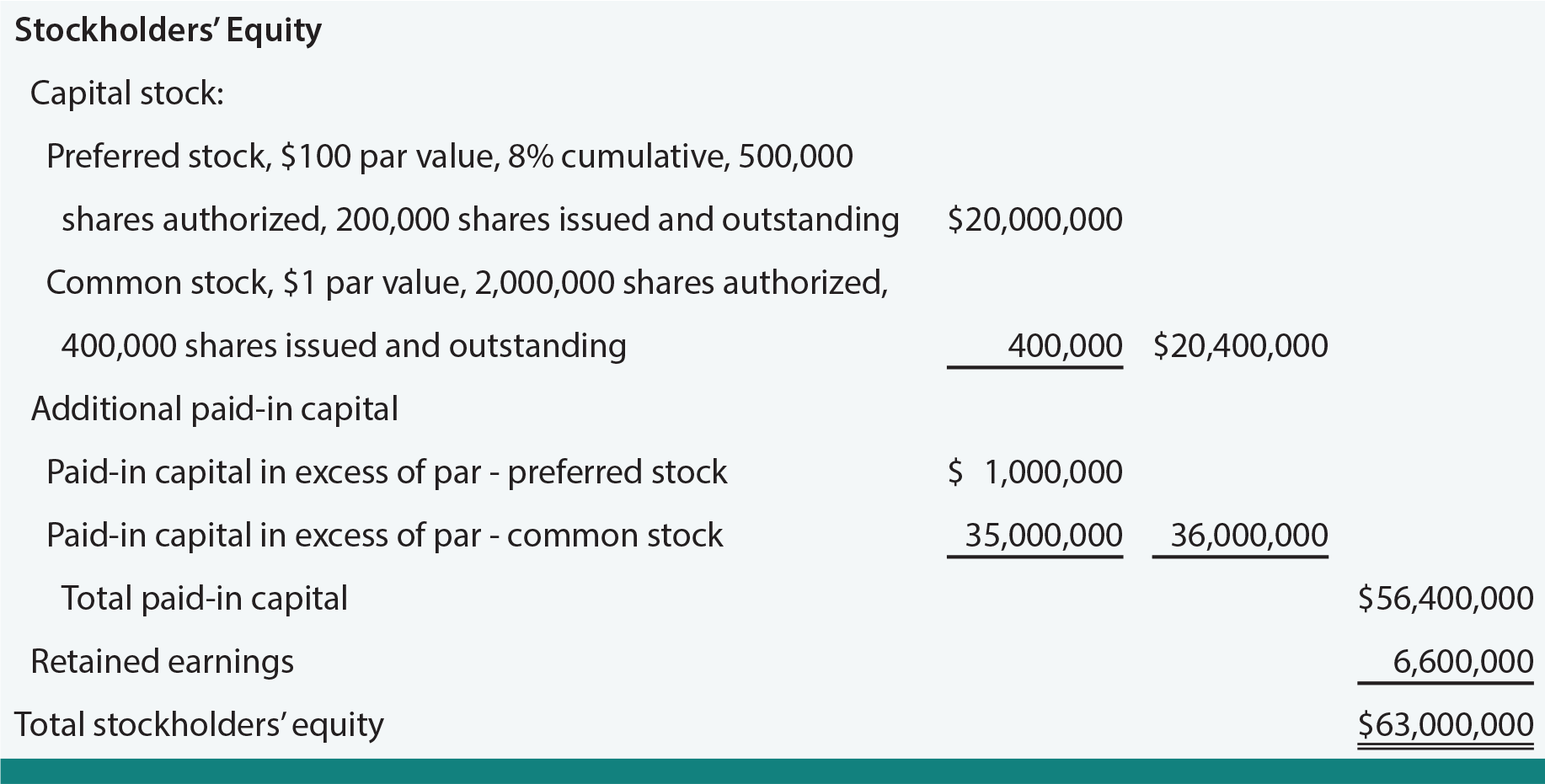

Cost of Preferred Stock 400 1 20 5000 20.

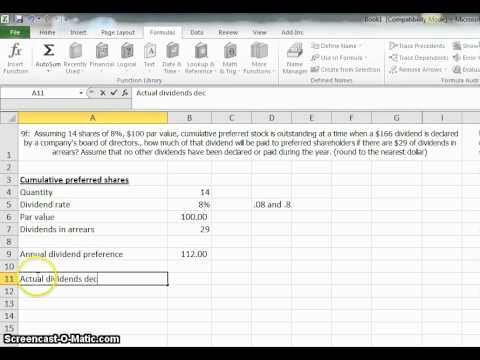

. Bot Corporation has common stock and cumulative preferred stock outstanding at December 31. Quarterly Dividend Yearly Dividend 4. No dividends can be paid to common stockholders in 2015.

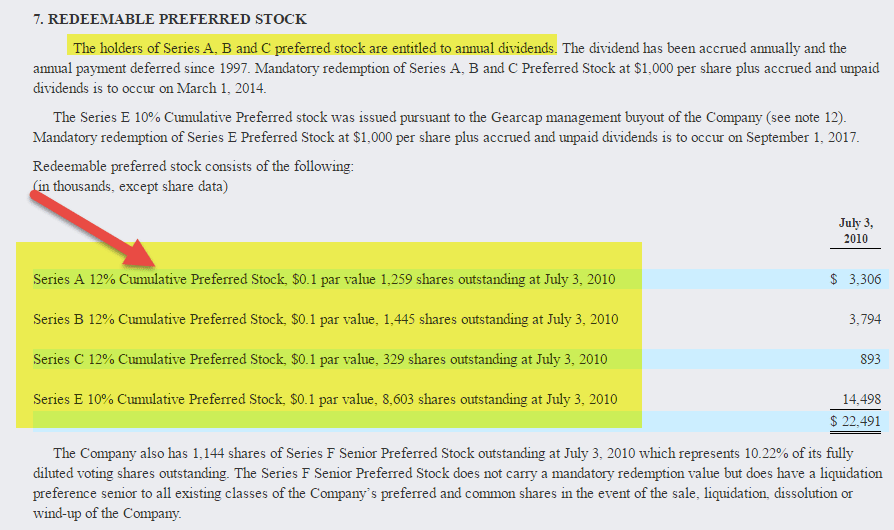

500000 for 2020 500000 for 2021. If board of directors decides to pay a dividend of 1200000 in 2021 the cumulative preferred stockholders will be paid a total dividend of 1000000 5 per share for two years. A nonperpetual preferred stock will have a stated buyback price and buyback date usually 30.

Following is the tabular expression of cumulative dividends in preferred. Annual preferred stock dividend Par value x Dividend rate. Perpetual Preferred Stock Price Fixed Dividend Dividend Yield.

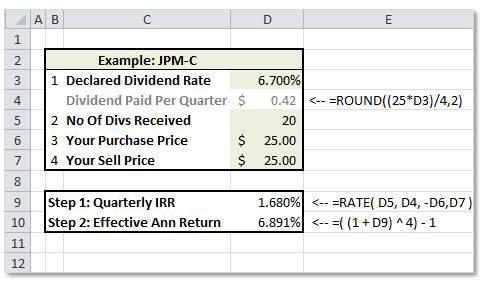

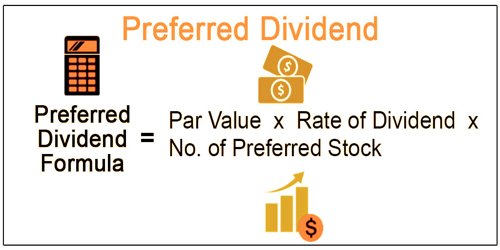

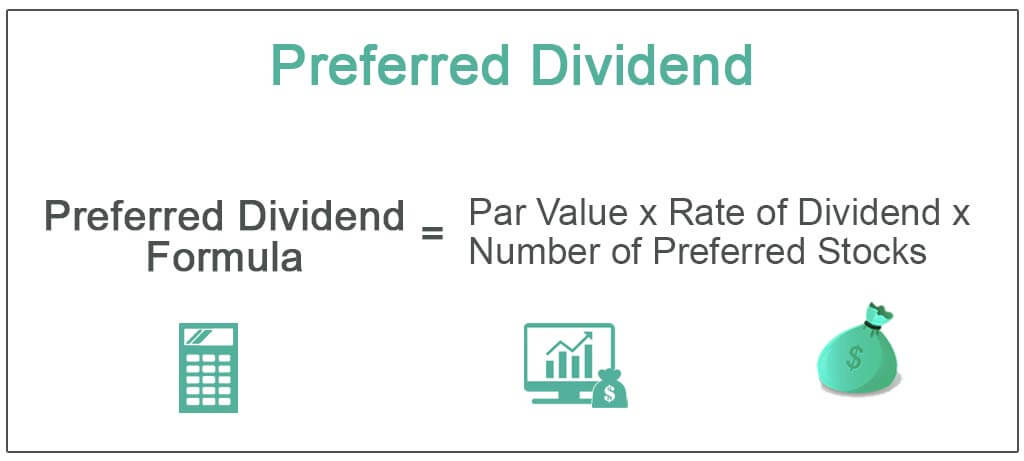

Preferred Dividend Formula Number of preferred stocks Par Value Rate of Dividend. The formula above tells us that the cost of preferred stock is equal to the expected preferred dividend amount in Year 1 divided by the current price of the preferred stock plus the perpetual. This calculates the dividend rate per share.

Rp 3 25 12. Cumulative preferred stock is preferred stock which pays cumulative dividends if a dividend payment is missed. Cumulative Dividend 5 x 100 5 Dividend per preferred share.

For this reason the cost of preferred stock formula mimics the perpetuity formula closely. The price the individual would want to pay for this security would be 20 divided by 055 which is calculated to be 400. Assume you have a share of cumulative preferred stock with a par value of 1000 and a 10 dividend yield.

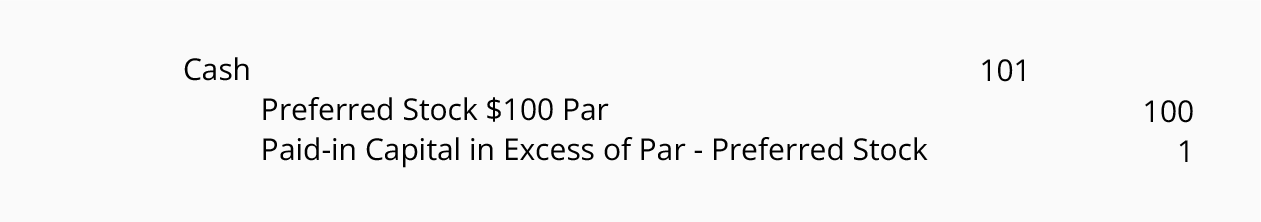

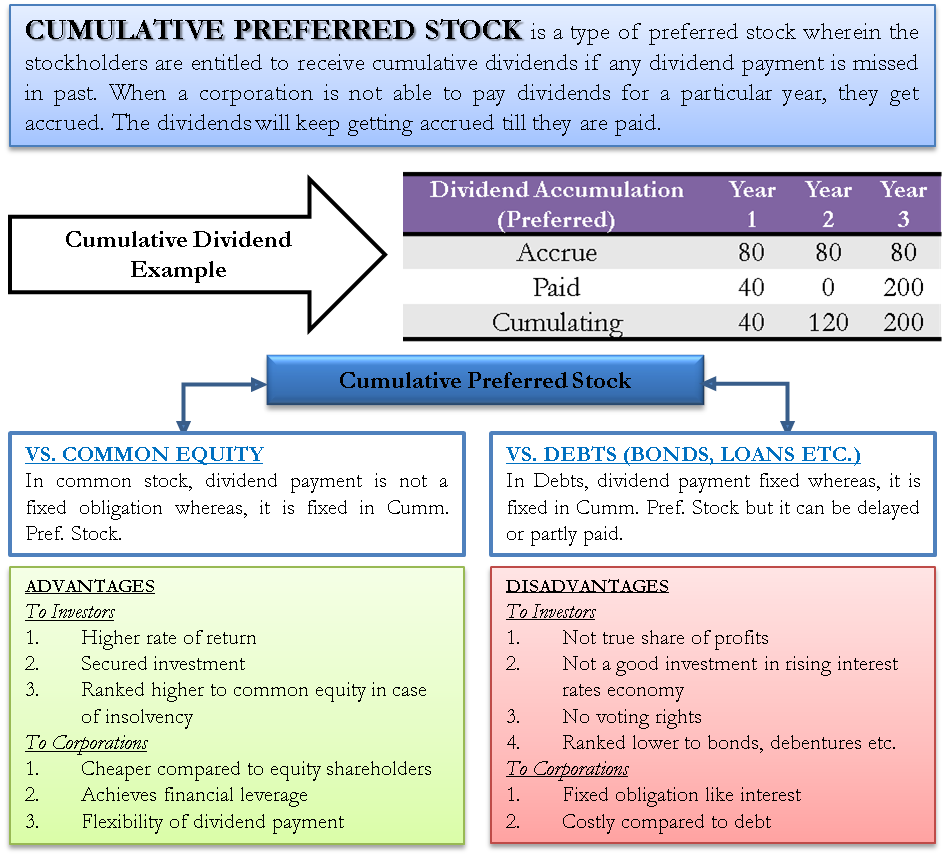

The company calculates the dividend to be paid by multiplying the par value times the dividend percent. An individual is considering investing in straight preferred stock that pays 20 per year in dividends. Cumulative preferred stock are those class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future.

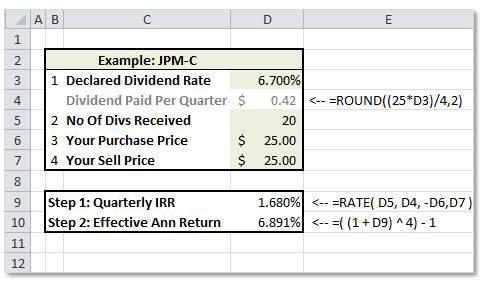

4500000 of the 6000000 dividends due on cumulative preferred stock can be paid out from net income in 2015 and 1500000 are carried forward. If the current share price is 25 what is the cost of preferred stock. Rp D dividend P0 price For example.

The cost of preferred stock formula. In case the company fails to pay 3 times the arrears will be. The basic two things to calculate the dividend are given.

Preferred Stock is calculated using the formula given below. We know the rate of dividend and also the par value of each share. How to Calculate Cumulative Preferred Stock.

Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks. It means that every year Urusula will get 8000 as dividends. The preferred stock dividends formula is par value x dividend rate x position skipped dividends.

Cumulative preferred stock not only pays current dividends but it also must eventually pay out any suspended dividends. The formula used to calculate the cost of preferred stock with growth is as follows. Cumulative Preferred stockholders get a fixed dividend rate irrespective of the profit margin Profit Margin Profit.

100 008 1000 8000. 10000000 10 6. Calculating cumulative dividends per share.

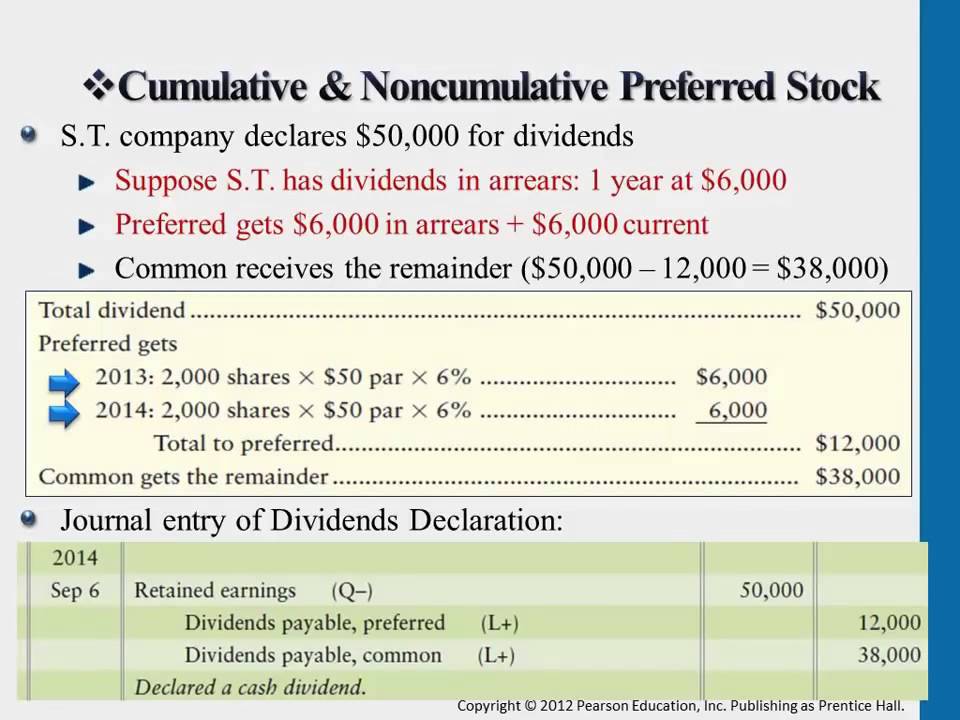

However such stocks are costlier do not have voting rights and cannot demand the interim dividends. The preferred stockholders must be paid 120 in arrears along with the current year dividend of 80. For this reason the cost of preferred stock formula mimics the perpetuity formula closely.

The remaining amount of 200000 can then be distributed among common stockholders. Cell Referencing Using Excel to Determine Dividends Paid to Common and Preferred Stockholders PROBLEM M. If Colin were to purchase 1000 preferred shares of ABC Company assuming that the preferred shares come with a cumulative dividend feature.

Preferred Stock Number of Outstanding Preferred Stocks Value of each Preferred Stock. The formula in such instruments for calculating its dividend is as follows. The annual dividend is 100.

Suppose cumulative preferred stock with a 10 dividend rate and a 1000 par has been issued. Rp D P0. A company has preferred stock that has an annual dividend of 3.

Preferred stocks usually pay dividends quarterly. It has been determined that based on risk the discount rate would be 5. A cumulative dividend is a required fixed distribution of earnings made to shareholders Preferred shares are the most common stock class providing a right to receive cumulative.

Formula Examples Worksheet 1. The company multiplies the dividend per share by the total number of preferred shares outstanding to determine the annual dividend amount to pay the preferred stockholders. Once all cumulative preferred stockholders are paid 200 the company may begin to pay other shareholders.

Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to cumulative preferred. Annual Dividend Ratevalue at par Unless the payment frequency is quarterly each quarter the dividend paid would be. Print Cumulative Preferred Stock.

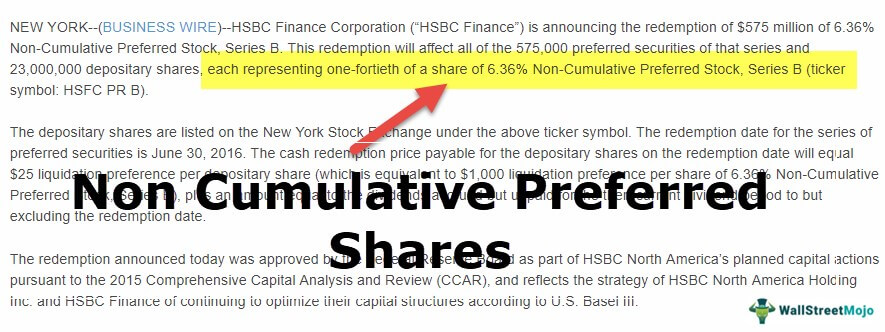

Dividend formula of Cumulative preference shares. If Colin were to purchase 1000 preferred shares of ABC Company assuming that the preferred shares come with a cumulative dividend feature payable once a year how much in dividends is he entitled to annually. The dividends on cumulative and non-cumulative preferred stock impact the computation of earnings per share differently.

In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula.

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Preferred Stock Accountingcoach

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

How To Calculate Cumulative Dividends Per Share The Motley Fool

Cumulative Preferred Stock Define Example Benefits Disadvantages

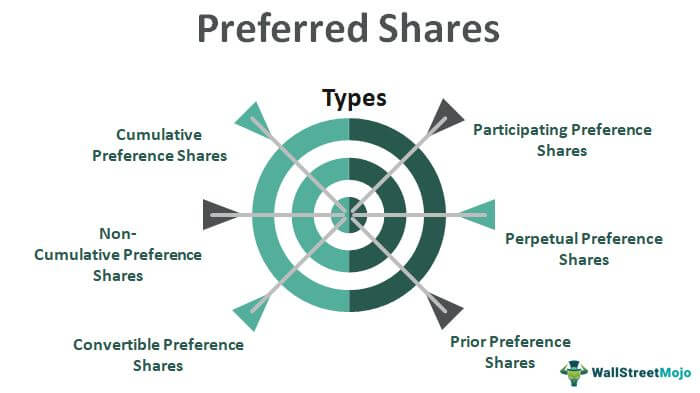

Preferred Shares Meaning Examples Top 6 Types

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Cumulative Noncumulative Preferred Stock Youtube

Preferred Dividend Assignment Point

Preferred Shares Meaning Examples Top 6 Types

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

How To Calculate Preferred Stock Outstanding The Motley Fool

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Preferred Dividend Definition Formula How To Calculate

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Common And Preferred Stock Principlesofaccounting Com

Non Cumulative Preference Shares Stock Top Examples Advantages